What Sets Us Apart

Founded by industry veterans, including the former Head of FTX Europe, who sold DigitalAssets.AG at a $400 million valuation

Pioneers of tokenized securities, the team behind the world's first regulatory-approved tokenized stocks, listed on Binance, Bittrex, and FTX

Licensed European MTF, operating Multi-Asset Exchange Technology with MiFID II approval and integrated self-clearing

Quantum-resilient self-custody, dedicated key pairs per user, full on-chain transparency, making proof-of-reserves obsolete

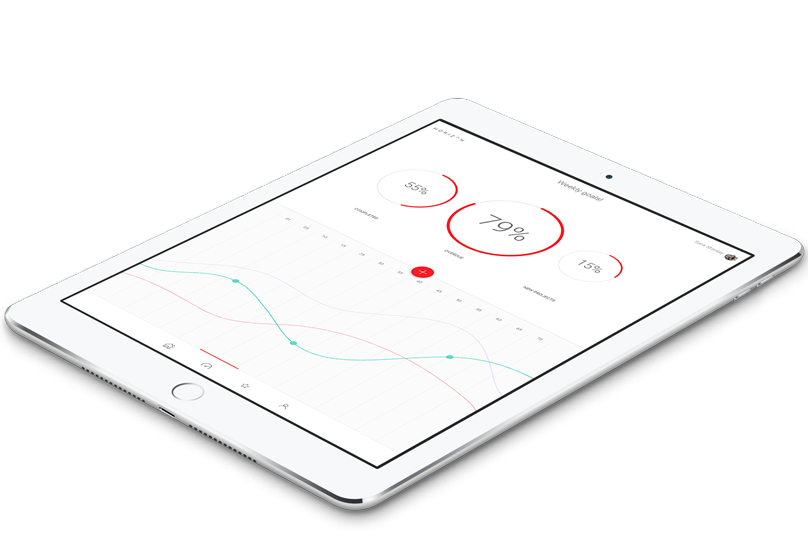

AI-powered risk prediction, our proprietary model, trained on 11.7+ billion trades, predicts retail trading outcomes with unprecedented accuracy

Enterprise-grade infrastructure, Kronos X® SaaS platform hosted at Equinix FR2 Frankfurt (alongside EUREX and Deutsche Börse) and U.S. West Coast

Our Brands

Core Technology Brand

Retail Brand

(Coming Q1 2026)

Retail Brand

(Coming Q2 2026)

Retail Brand

(Coming Q1 2026)

Financial Market Infrastructure that suits your needs

Regulated infrastructure for modern markets:

- Tokenized RWAs — stocks, options, and more

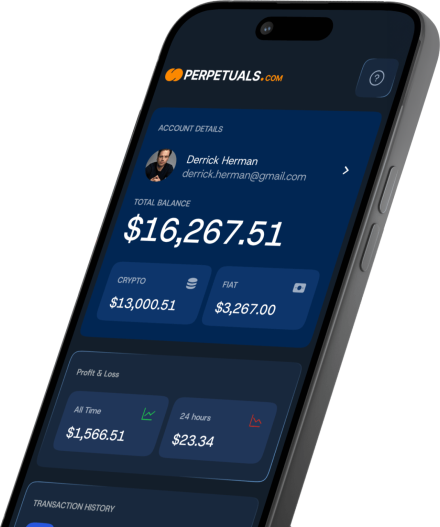

- Perpetual futures trading

- Quantum-resilient self-custody wallets

- 24/7 blockchain-based settlement

Delivered as SaaS from Frankfurt and the U.S. West Coast.

Looking for a Crypto Custody Solution?

Take full control of your digital assets with our Quantum-Resilient Vaults, institutional-grade self-custody without relying on third-party custodians or hardware wallets.

User Protection

BayesShield — our proprietary AI trained on 11.7+ billion trades — evaluates every new position in real-time, calculating win/loss probability to shield retail traders from high-risk trades.

Multi Asset Exchange

Trade and settle around the clock — our technology for EU-regulated Multi Asset Exchanges supports crypto spot, derivatives (perpetuals, futures, options, swaps), tokenized assets, structured products, and pre-IPO securities. All under one roof, 24/7.

Our Experience

Built by pioneers — the team behind Europe's first tokenized stocks, regulated perpetual futures, and pre-IPO contracts for Coinbase, Robinhood, and Airbnb. Trusted by Binance, FTX, Bittrex, and others.

World Class Technology

Technology Matters

Perpetuals.com operates regulated financial market infrastructure at the intersection of traditional finance and digital assets. Our B2B offerings include capital markets technology delivered as SaaS and institutional-grade custody through our Crypto Vault. For consumers, we provide compliant retail trading and prediction market platforms.

Trading & Settlement

Data Centers

Trades Analyzed

How we can help your business

Get ready for the future of finance

We provide white-label infrastructure that lets financial and crypto market service providers deliver institutional-quality trading technology to their clients. Our Kronos® Multi-Asset Exchange meets the full spectrum of European regulatory requirements — MiFID II (MTF), MiCA, DORA, EMIR, MiFIR, and GDPR — and operates under an EU MTF license recognized as equivalent in the United States of America, Australia and Hong Kong.

Easy to integrate

Our leveraged products reduce the complexity of traditional margin trading. They are designed to operate without traditional margin calculations or margin calls and to reduce liquidation-related risk, using a simple purchase-based model similar to buying stocks.

For providers, this means fast integration with minimal infrastructure. For end users, it means leveraged exposure with a pre-defined maximum loss.

High Performance

Perpetuals.com operates proprietary trading infrastructure across strategically located data centers in Germany and the U.S. West Coast, providing robust coverage for European and North American markets.

For clients where microseconds matter, we offer colocation services within our facilities — enabling direct proximity to our matching engines and minimizing execution latency.

Become Crypto Ready

Traditional financial institutions face a build-or-buy decision when entering crypto markets. Our white-label infrastructure eliminates that trade-off.

Deploy a complete crypto offering under your own brand: a quantum-resilient self-custody wallet that keeps clients in control of their assets, seamless connectivity to spot and derivatives liquidity, and access to tokenized equities — all within a single, compliance-ready platform.

Your clients get institutional-grade crypto access. You retain the relationship.